Types:

Here we will show the example of a $100k loan with 12% interest, for one year.

This is the standard type you are likely to be familar with. You receive payments each month based on the amortized amount of the loan, divided by the number of payments.

| Month # | Payment | Total |

|---|---|---|

| 1 | $8,884.88 | $8,884.88 |

| 2 | $8,884.88 | $17,769.76 |

| 3 | $8,884.88 | $26,654.64 |

| 4 | $8,884.88 | $35,539.52 |

| 5 | $8,884.88 | $44,424.40 |

| 6 | $8,884.88 | $53,309.28 |

| 7 | $8,884.88 | $62,194.16 |

| 8 | $8,884.88 | $71,079.04 |

| 9 | $8,884.88 | $79,963.92 |

| 10 | $8,884.88 | $88,848.80 |

| 11 | $8,884.88 | $97,733.68 |

| 12 | $8,884.88 | $106,618.56 |

Here you see you would get a total payback of $106,618.56, meaning a $6,618.56 profit.

You may note that the profit is just over 6.6% of the $100,000. This is because a portion of the principle is being paid each month, lowering the acrued interest overall.

This is a loan where you only receive the accured interest each month. The full principle amount is still owed after each month.

| Month # | Payment | Total |

|---|---|---|

| 1 | $1,000.00 | $1,000.00 |

| 2 | $1,000.00 | $2,000.00 |

| 3 | $1,000.00 | $3,000.00 |

| 4 | $1,000.00 | $4,000.00 |

| 5 | $1,000.00 | $5,000.00 |

| 6 | $1,000.00 | $6,000.00 |

| 7 | $1,000.00 | $7,000.00 |

| 8 | $1,000.00 | $8,000.00 |

| 9 | $1,000.00 | $9,000.00 |

| 10 | $1,000.00 | $10,000.00 |

| 11 | $1,000.00 | $11,000.00 |

| 12 | $101,000.00 | $112,000.00 |

Note: 12% / 12 months = 1% per month.

Here you see you would get a total payback of $112,000.00, meaning a $12,000.00 profit.

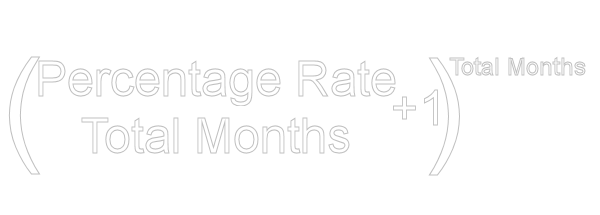

This is a loan where you only receive one payment, principle and compounded interest, all at once, at the end of the term.

| Month # | Payment | Interest | Total Interest | Total Payment |

|---|---|---|---|---|

| 1 | $0.00 | $1,000.00 | $1,000.00 | $0.00 |

| 2 | $0.00 | $1,010.00 | $2,010.00 | $0.00 |

| 3 | $0.00 | $1,020.10 | $3,030.10 | $0.00 |

| 4 | $0.00 | $1,030.30 | $4,060.40 | $0.00 |

| 5 | $0.00 | $1,040.61 | $5,101.01 | $0.00 |

| 6 | $0.00 | $1,051.01 | $6,152.02 | $0.00 |

| 7 | $0.00 | $1,061.52 | $7,213.54 | $0.00 |

| 8 | $0.00 | $1,072.13 | $8,285.67 | $0.00 |

| 9 | $0.00 | $1,082.86 | $9,368.53 | $0.00 |

| 10 | $0.00 | $1,093.68 | $10,462.21 | $0.00 |

| 11 | $0.00 | $1,104.62 | $11,566.83 | $0.00 |

| 12 | $112,682.50 | $1,115.67 | $12,682.50 | $112,682.50 |

Here you see you would get a total payback of $112,682.50, meaning a $12,682.50 profit.

This is the best profitablity, the downside is that you must wait for the entire term to elapse before any payment is made.

Longer terms would lead to intest growing much greater. For example, the same loan for 24 months, would give $26,973.46 in interest, more than just the doubling one might expect.

This is a loan that is a combination of other types.

For example, you might have an interest only loan that is paid annually. Or maybe a Standard loan, but payments are every 3 months instead of every month.

A Lump Sum loan can be seen as a Standard loan, but with only one payment.

An example of Interest Only, being paid quarterly.

| Month # | Payment | Interest | Total Payment |

|---|---|---|---|

| 1 | $0.00 | $1,000.00 | $0.00 |

| 2 | $0.00 | $1,010.00 | $0.00 |

| 3 | $3,030.10 | $1,020.10 | $3,030.10 |

| 4 | $0.00 | $1,000.00 | $0.00 |

| 5 | $0.00 | $1,010.00 | $0.00 |

| 6 | $3,030.10 | $1,020.10 | $6,060.20 |

| 7 | $0.00 | $1,000.00 | $0.00 |

| 8 | $0.00 | $1,010.00 | $0.00 |

| 9 | $3,030.10 | $1,020.10 | $9,090.30 |

| 10 | $0.00 | $1,000.00 | $0.00 |

| 11 | $0.00 | $1,010.00 | $0.00 |

| 12 | $103,030.10 | $3,030.10 | $112,120.40 |

Here you see you would get a total payback of $112,120.40, meaning a $12,120.40 profit.